ESSER III

States and school districts are receiving ESSER (Elementary and Secondary School Emergency Relief) funding, part of the federal coronavirus relief package. In the third round of funding, under the ESSER III federal program, Eugene School District 4J has been awarded $36.9 million in one-time grant funds. Grant funds must be expended by September 30, 2024.

The funding is available to help safely reopen schools and address the impacts of the pandemic on students’ academic, social, emotional, and mental health needs. Appropriate uses include interventions to address “learning loss”—delays in students’ academic progress during the global health crisis—and to support equity with programs and services focused on student populations that have been disproportionately impacted by the pandemic.

Student Success Act – Student Investment Account (SSA SIA)

Student Investment Account (SIA) funds are part of the Student Success Act, a historic investment in schools passed by the Oregon Legislature in spring 2019. Each Oregon school district has developed a plan to invest these funds to increase academic achievement, close gaps between groups of students and meet students’ mental and behavioral health needs. Funds may be spent in four broad categories: increasing learning time, addressing student health and safety needs, reducing class size / increasing classroom staffing, and expanding well-rounded learning opportunities. 4J conducted an expansive public engagement process with multiple and diverse stakeholders to inform development of the district’s plan in 2019–20.

- Original Plan, March 2020:

Information • Overview • Grant Application • Integrated Plan - Reduced Plan, October 2020:

Information • Overview • Grant Agreement • Strategies and Budget - 2020–21 Annual Report, November 2021:

Information • Overview • Annual Report Questions

High School Success (Measure 98)

High School Success is a fund initiated by Ballot Measure 98 in November 2016. High School Success funds are targeted to improve student progress toward graduation, increase graduation rates, and improve graduates’ readiness for college and careers. Funding is provided to establish or expand programs for dropout prevention, career and technical education, and college-level education opportunities.

School Bond Measures

State school funding does not provide for building, renovating or replacing schools. Under Oregon’s tax law limitations, communities have two options to provide local school funding: Bonds for capital improvements such as buildings, and local option levies for operating costs. By law, when voters pass a capital bond measure, the money may only be spent on capital improvements such as facilities, equipment, curriculum and technology. 4J voters have approved multiple general obligation bonds for capital improvements over time, most recently in 2018 and 2013.

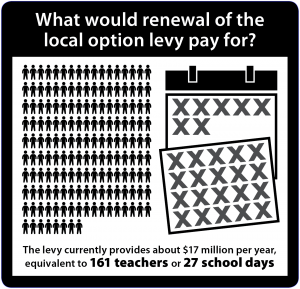

Local Option Levy

The Eugene School District 4J local option levy is a property tax that provides money for school operations in 4J schools and charter schools. Under Oregon property tax law, a local option levy is the only tool a school district has to allow the community to increase funding for local school operations. While bond funds can be spent only on capital improvements such as buildings, buses and technology, levies pay for school operations: staff, class sizes, programs, utilities and other daily operating costs. Revenues from the local option levy are part of the district’s general fund.

The Eugene School District 4J local option levy is a property tax that provides money for school operations in 4J schools and charter schools. Under Oregon property tax law, a local option levy is the only tool a school district has to allow the community to increase funding for local school operations. While bond funds can be spent only on capital improvements such as buildings, buses and technology, levies pay for school operations: staff, class sizes, programs, utilities and other daily operating costs. Revenues from the local option levy are part of the district’s general fund.