Voter Approved Physical Plant & Equipment Levy (PPEL) on March Ballot

Facility Facts

With a certified enrollment of 4,782 students in the 2020-21 school year, Ottumwa is ranked 19th in size out of 327 school districts in Iowa. Our students are served in nine separate school buildings. The district also houses operations and administration in two additional buildings. The combined area of these facilities is approximately 759,000 sq. ft.

PPEL Fund Resources

- Ottumwa currently utilizes board approved PPEL which is $0.33 levy per $1,000 of property valuation.

- These resources can be used primarily for the purchase and improvement of grounds; construction of schoolhouses or buildings; purchase, lease, or lease-purchase of equipment or technology; repairing, remodeling, reconstructing, improving, or expanding the schoolhouse or buildings; and additions to existing schoolhouses. (Iowa Code 298.3).

- For fiscal year 2020-21, Ottumwa will receive $277,602 in PPEL funds.

Other Resources Used to Fill the Gap

- GENERAL FUND - Approximately $700,000 is allocated from the general fund for building and grounds maintenance, services, and repairs which could be funded by PPEL resources.

- CAPITAL PROJECTS FUND - In 2020-21, just over $1.1 million of capital fund resources are allocated towards general facility maintenance and repairs.

- An additional $600,000 is allocated towards student and staff technology leasing costs.

Voter Approved PPEL

- Ottumwa Schools is recommending placing the question of a voter-approved PPEL before Ottumwa voters in March 2021. 82% of all school districts in Iowa have a voter approved PPEL. Only 2 districts with over 2,500 students do not have a voter approved PPEL.

- A voter-approved PPEL of $1.34/$1,000 would generate approximately $1.14 million beginning in the 2021-22 school year and an estimated $12 million over the next 10 years that could be used primarily for building repairs, maintenance, and instructional technology purchases.

- Through board approved changes to the existing Instructional Support Levy, the district can add a voter-approved PPEL without any property tax increase. In fact, we can do it while still providing residents and businesses a property tax decrease.

How Can Property Taxes Not Increase

- By shifting a portion of the Instructional Support Levy to an income tax surtax, capacity is added to support a voted PPEL.

- The district estimates that with a voter-approved PPEL, the school portion of property taxes will decrease from $14.72 to $14.22, a $.50 decline.

- This reduction would bring the school levy rate to the lowest it has been since 2007.

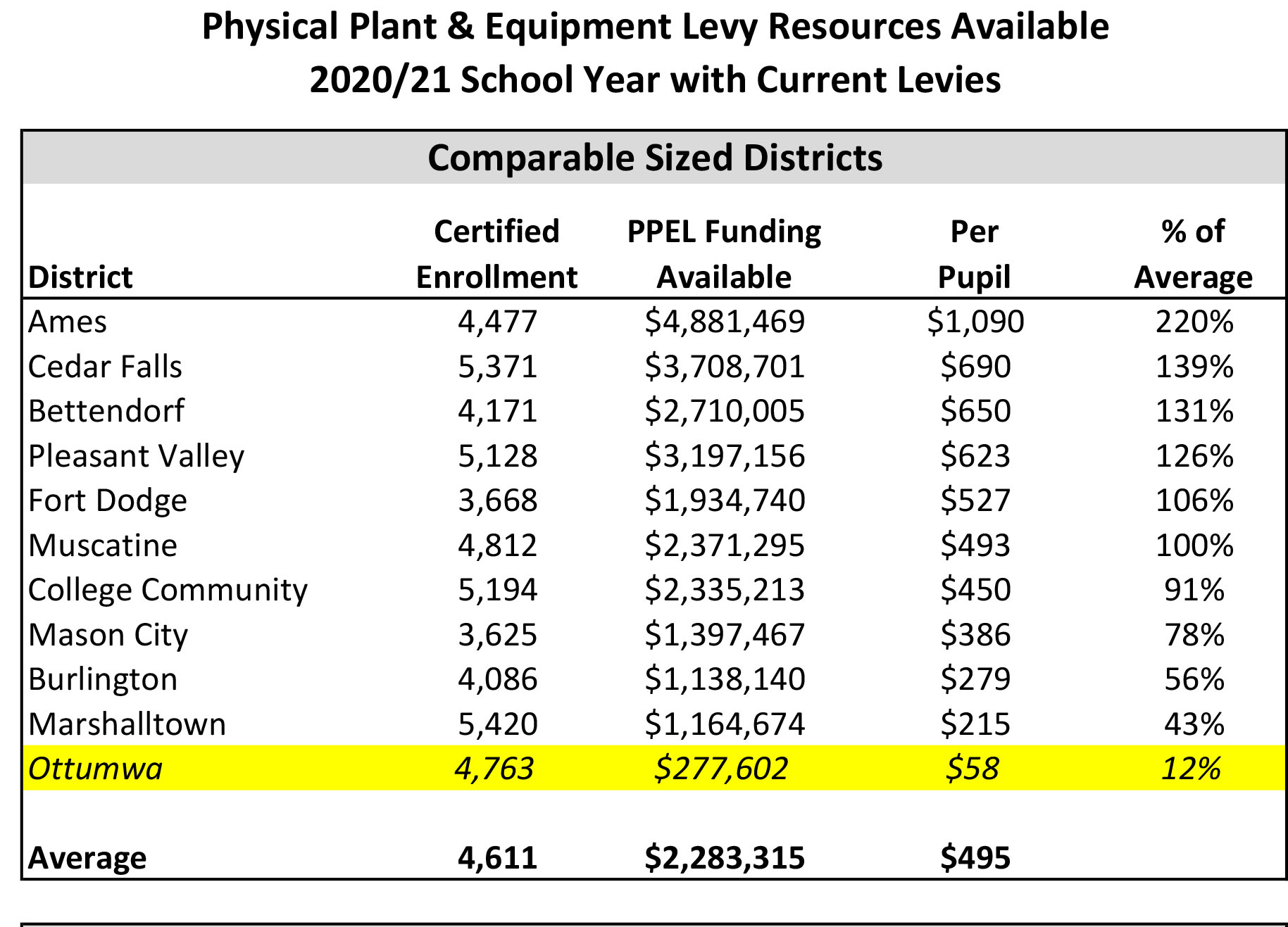

Compare Ottumwa to Neighboring Districts

Ottumwa currently ranks lowest in the state for PPEL resources available at $58 per student. In a group of similar-sized districts (see chart below), the average PPEL resources available are $495 per students. In southeast Iowa (see chart above), this average is lower at $233 but still 4 times the amount generated for Ottumwa students.