About the South Colonie proposed 2023-24 budget plan

South Colonie is committed to providing detailed information to our stakeholders about the budget planning process and proposed spending plan. If you would like additional information on a budget topic that is not addressed in one of the sections below, please send your questions to communications@scolonie.org.

General South Colonie Budget Information

Spending plan highlights

Bus Proposition Details

Governor’s Budget

Budget 101

Absentee Ballot Information

General South Colonie Budget Information

Q: When is the budget vote and board election?

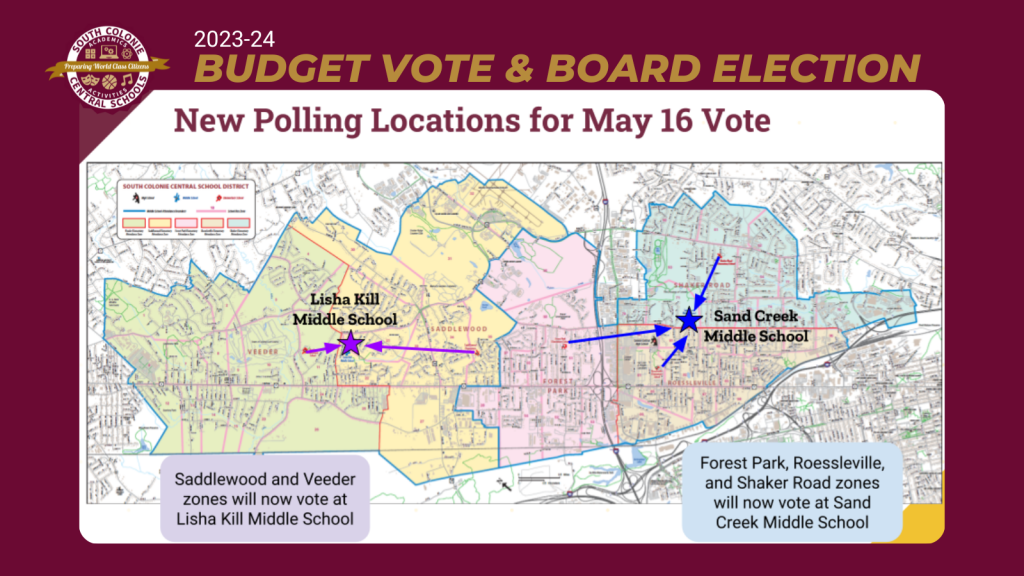

A: The annual district budget vote will be held on Tuesday, May, 16, from 11 a.m. to 8 p.m. Voting will take place this year at new polling locations at both Sand Creek and Lisha Kill Middle Schools. Residents who are unsure on their assigned polling location can look it up here: https://vip.ntsteamed.com.*

*Please note when entering your birthday you will need to include the following symbol: /

Q: What are the 2023-24 budget priorities for the District?

A: As the South Colonie plans for the 2023-24 school year, the focus has been on maintaining programs that provide equitable academic opportunities and services for students, many which have been grant funded through stimulus funds for the past two years. The priorities will be the expansion of ENL (English as a new language) programming, expanding universal pre-K programming, strengthening the continuum of services for our special education population, and planning for both the sustainability of our programs, staffing, and facilities for the next generation of Colonie.

Q: What does the 2023-24 South Colonie financial landscape look like?

A: Based on the South Colonie second draft budget, South Colonie administration is proposing $122,194,702 with a budget-to-budget change over the current school year of +$8,753,788, or 7.7%

Spending Plan highlights

Q: What are the 2022-23 Program Enhancements?

A: The proposed 2023-24 budget preserves all current programs and services and provides key enhancements as outlined below:

Transportation and O&M Highlights

-

- Transportation technology upgrades to improve ease of transportation route mapping for staff leading to an enhanced transportation experience for students and families.

- Bus maintenance replacement plan to ensure students are transported on buses that meet the latest safety standards while allowing the district to phase out older, high mileage vehicles to avoid the cost inefficiencies related to keeping them in service.

- Implementation of districtwide maintenance and paving plan to support on-going wear and tear.

Staffing

-

- 1 Full time sub bus driver

- 1 Pupil trans analyst

Student Support Services Highlights

-

- Student support services highlights include additional staff to support the growing needs of ENL (English New Language) and special education student populations.

- Continued emphasis on social-emotional health through sustaining previously added staffing for those areas.

Staffing

-

- 3 Special education teachers

- 2 TAs

- 2 ENL teachers

- 1 ENL TA

- 2 Monitors

- 1 Administrator

Instructional Highlights

-

- The instructional highlights include additional teachers to enhance programs and support smaller class sizes.

- Additional staff to support expanded UPK programming.

- Continued STEAM education programming at the elementary and middle school levels.

- Continued career exploration program for students to gain knowledge and exposure to the most desired and applicable career experiences, college majors, associate degrees and skilled trade professions.

- Implementation of districtwide technology replacement plan to support on-going wear and tear and applicable upgrades.

Staffing

-

- 7.6 Teachers to enhance programs and reduce class sizes

- 2 Teachers/TAs for UPK expansion

- 1 Administrator

- 50 Stimulus funded positions to continue

- Coaching/advisor positions

- Replace retirements

Human Resources Highlights

Continue paperless workflow initiatives through SchoolFront to improve internal efficiencies.

Staffing

-

- 1.0 Payroll/HR Support (shared position)

Communications Highlights

-

- Continue to prioritize inclusive communications with students, staff, and community members.

- Implementation of new district website.

Staffing

- 0.5 Communications Specialist (offset expense by reducing BOCES service)

Bus Proposition Details

Q: What is included in the Bus proposition?

A: In addition to voting on the school budget, South Colonie residents will be asked to consider authorizing the purchase of eight replacement school buses of various sizes—six (6) 66 passenger buses, one (1) 18/3 wheelchair bus and one (1) 42 passenger bus — overall cost not to exceed $1,318,000.

The bus purchase is part of an ongoing bus replacement plan designed to ensure students are transported on buses that meet the latest safety standards while allowing the district to phase out older, high mileage vehicles to avoid the cost inefficiencies related to keeping them in service. This proposition has no tax impact.

Q: I know there was legislation requiring school districts to purchase electric buses. Why is the South Colonie Central School District purchasing non-electric vehicles?

A: School Districts across New York state are required to begin purchasing zero-emission buses as part of the normal replacement of each system’s fleet and related equipment and facilities starting in 2027 with the school’s ability to do a two-year waiver (extending the first required purchase to 2029). The deadline for school district’s to be fully zero-emission (all-electric) school buses is by July 1, 2035.

On average, electric buses cost two to three times as much as replacement buses powered by diesel or another alternative fuel. An electric bus is $350,000 compared to $120,000 for a traditional bus. Even after available grants, the cost is still $280,000 or more per electric bus.

Additionally, the electric buses have limited battery capacity which limits total daily mileage capacity.

The district currently has an eight-year replacement life cycle for all buses and non-electric buses purchased this year will be able to complete the full life cycle prior to the deadline of 2035.

Additionally, the South Colonie Central School district does not currently have the infrastructure or funding in place to support electric buses and/or accompanying charging stations at its current transportation facility located on Winston Place.

On Oct. 18, 2022 voters in the South Colonie Central School District approved two capital project propositions that together will result in more than $120 million in improvements across the district. The third phase of the project includes a new transportation center. The hope is that funding will also be available from the state at that time of the build to support the associated costs with installing charging equipment.

Governor’s Budget information

Q: Can you provide a summary of state aid and education provisions in the final 2023-24 state budget?

A: On Tuesday, May 2, New York state lawmakers finalized the fiscal year 2023 state budget that establishes state education funding for levels for school districts for the coming year.

The state budget includes the final year of a three-year phase-in of full Foundation Aid funding, providing a minimum 3% Foundation Aid increase for all districts. In addition, the budget contains full funding for expense-based aids to support student transportation, building projects, BOCES services and special education. The budget also provides some funding for expanding access to school meals and additional allocations to the state’s Universal Prekindergarten program.

Q: What are BOCES services and BOCES aid?

A: Boards of Cooperative Educational Services, or BOCES, provide shared services to school districts as a way to pool resources and share costs. Sharing allows districts to provide programs and services that they might not be able to afford otherwise. A district using BOCES services for the current school year is reimbursed a portion of the cost of the services in the following school year by New York state. The amount returned to each district varies by service and is based on a formula that takes into account the district’s financial resources. The South Colonie Central School District receives 55.7% reimbursement on the aidable BOCES services it uses.

Budget 101

Q: What happens if the South Colonie budget doesn’t pass?

A: Under New York state law, if the school budget is defeated, the board of education has two options: put the same or a modified budget up for another vote, or immediately adopt a contingent budget. If residents defeat the proposed budget during a second vote, the board must adopt a contingent budget.

Q: What is a contingent budget?

A: State law mandates that under a contingent budget, a school district must adopt a budget with no tax levy increase and eliminate all non-contingent expenses, such as certain student supplies, certain equipment purchases and community use of school facilities that results in a district expense. (In other words, the district would likely need to charge fees for any community use of buildings and grounds.) The administrative budget would also be subject to certain restrictions.

Q: What is the difference between the tax levy and tax rate?

A: The tax levy is the total amount of money a school district raises in taxes each year from all property owners in the district.

The tax rate is the amount paid for each $1,000 of taxable assessed value of property. The rate is used to calculate each individual property tax bill. In districts that cover just one municipality, the tax rate is figured by dividing the tax levy by the total taxable assessed value of the district, then multiplying by 1,000. This gives you the tax rate, which is expressed as the amount per $1,000 of assessed property value.

In districts that encompass more than one municipality, equalization rates are factored in as well to assign a fair share of the tax levy among the municipalities and to the taxpayers within them.

Q: What is an equalization rate?

A: In New York state, each municipality determines its own level of property assessment. This means that property in different municipalities could be assessed less than, higher than or at actual full market value (i.e., the price for which a property could be sold). In order to distribute school district or county taxes evenly among multiple municipalities, the level of assessment for each of those municipalities must be equalized to full market value. To do this, the state uses an equalization rate:

Total assessed value of the municipality ÷ Total market value of the municipality = Equalization rate.

Once the full market value of each municipality is established, the school district or county can determine the amount of taxes that should be collected from each municipality.

Click here to find more information about equalization rates and local assessment rolls.

Q: What is the tax levy limit, or tax cap?

A: The tax levy limit is the highest allowable tax levy (before exemptions) that a school district can propose as part of its annual budget with the support of a simple majority of voters (50% + 1) required for approval. In other words, if a district proposes a tax levy increase at or below the limit, a simple majority of voters is needed for the budget to pass. Any proposed tax levy amount above this limit would require the support of a 60% supermajority of voters to be approved. The tax levy limit sets a threshold requiring districts to obtain a higher level of community support for a proposed tax levy above a certain amount.

Q: What is a “fund balance” and how does it help offset what I pay in school taxes?

A: Fund balance is created when there is money left at the end of the fiscal year, either by the district spending less than budgeted or receiving more revenue than anticipated. An “unassigned” fund balance provides monies that can be used for a variety of needs, unlike reserve funds, which are targeted for specific purposes. While recommendations from within the financial industry often suggest that an organization should have an unassigned fund balance of between 5 and 10 percent of their total annual budget, New York state limits school districts’ fund balances to 4 percent..

Q: What is the state’s School Tax Reduction, or STAR, Program?

A: New York State’s School Tax Relief Program, or STAR, provides partial school property tax savings to eligible homeowners. Most New Yorkers who own and live in their homes are eligible for STAR savings on their primary residences. Because the STAR program is not a district program, taxpayers STAR savings are not factored into a school budget.

More information about STAR can be found at: https://www.tax.ny.gov/pit/property/star/eligibility.htm.

Q: Why do salaries and benefits comprise so much of the budget?

A: It takes many people to create and maintain a safe and productive learning environment for nearly 4,800 children in our eight schools. Employees teach, transport, coach and care for the community’s children. They clean buildings, cook meals, maintain playing fields, order supplies, comply with regulations and make decisions so that schools run effectively and efficiently and more. The district has nearly 878 employees, including many part-time staff members. Every year, approximately 80% percent of the district’s budget goes to pay salaries and benefits.

Q: What is a capital reserve fund?

A: A capital reserve fund allows the district to set aside money for future capital construction projects. Much like a savings account, this money is set aside so that a significant project or expense does not affect the budget all at once. The fund cannot be established without voter approval, and reserve funds cannot be spent without voter approval. Because capital assets have a predetermined useful life expectancy, a capital reserve fund reduces the need to borrow money to replace those assets in the future, lowering debt and interest costs while also enabling the district to still maximize state aid.

South Colonie obtained voter approval on November 14, 2017 to establish a Capital Reserve Fund to set aside money for future capital improvement projects. The capital reserve fund has a maximum capital reserve amount of $10,000,000 and may be funded over a 10 year period. The Capital Reserve is funded from monies not needed for current purposes and unexpended balances remaining at the end of a fiscal year.

The South Colonie Capital Reserve account is depleted after allocating $2,100,000 to the Next Generation Capital Project. Should there be an operating surplus at the end of the fiscal year, funds can be added to the reserve by Board resolution to build this reserve back up for the next project.

Absentee Ballot Information

Q: Will absentee ballots be mailed to all registered voters?

A: No. Absentee ballots will not be mailed to all registered voters as they were during 2020’s unprecedented school budget vote. Qualified voters who would need to vote by absentee ballot must submit an application unless they are listed on the voter rolls as “permanently disabled.”

Q: Who can request an absentee ballot?

A: Qualified voters can request an absentee ballot if they will not be able to vote in person due to illness or physical disability, hospitalization, incarceration (unless incarcerated for a felony), travel outside the voter’s county or city of residence for employment or business reasons, studies, primary caregiver obligations or vacation on the day of election.

Q: When should I submit my absentee ballot application?

A: Applications may not be submitted more than 30 days prior to the election (April 16).

If you would like your absentee ballot mailed to you, you must submit your application at least seven days before the vote (May 9) If you want to pick your ballot up from the district, you must submit your application one day before the vote (May 16).

Voters who wish to vote in the May 16 school budget vote and board election via absentee ballot are encouraged to submit their application as soon as they have filled it out.

Q: I received my absentee ballot. Now what?

A: Once you receive your ballot, carefully read and follow the directions for filling out the ballot. Then, sign and date the envelope where indicated. If your envelope is unsigned or illegible, your vote can not legally be counted.

Q: I made a mistake. Can I get a new ballot?

A: If you tear, deface or wrongly mark your ballot, contact the district clerk at 518-869-3576 ext. 0442 immediately for instructions on how to obtain a new ballot.

Q: How should I send my ballot back to the school district?

A: Ballots may be returned by mail, or returned in person to the District Office. If your ballot does not arrive at the district office by 5 p.m. on the day of the vote, it will not be counted.

Q: What happens when the district receives my ballot?

A: The district will collect and hold onto all the ballots until the day of the vote. Ballots will be separated from the envelope that bears your name, return address, or other personally identifiable information before they are counted.

Q: Why do I have to sign my name on the envelope?

A: Just as voters are asked to sign a register when they vote in person, voters using absentee ballots are asked to provide a signature. This signature constitutes an affidavit — you are attesting to your identity as a voter who is qualified to cast a ballot in this election. This information is recorded on the district’s voter rolls — a list of names of all the people who cast ballots.

Q: Is my vote still confidential?

A: Yes. While your name will be registered on the district’s voter rolls, your ballot will be separated from the envelope that bears your name, return address, or other personally identifiable information before the envelope holding your ballot is opened.

Q: How can my vote be confidential if the count is open to the public?

A: Since ballots are separated from personally identifiable information before they are counted, the public counting process is anonymous. No one viewing the counting of ballots will be able to match a voter’s personally identifiable information with their specific ballot.

Q: When will the results of the budget vote and board election become available to the public?

A: The annual school budget vote is an official public meeting of the district, and as such, it is open to the public. South Colonie will begin the counting process on Tuesday, May 16, 2021 at 8 p.m. (immediately after the polls close.) The results will be available as soon as all ballots have been accounted for, but no later than 5 p.m. on May 17 (24 hours following the deadline for ballots to be received by the district). Results are typically shared with the media immediately following the count. They are also published on the district’s website.

Q: Whom do I contact if I have any additional questions?

A: Please contact the district clerk Amber Lanigan by email at lanigana@scolonie.org or by phone at 518-869-3576 ext. 0442.