Impact to Taxpayers

-

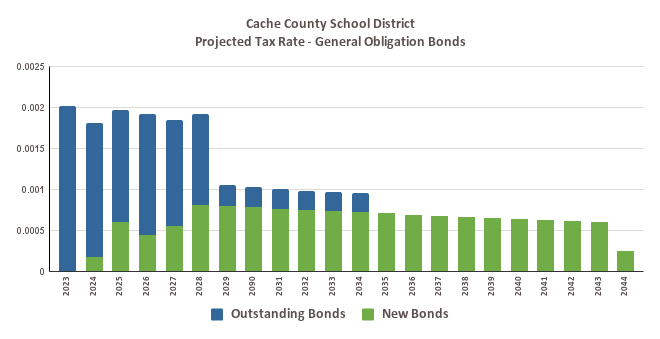

Property owners can anticipate no tax rate increase related to this bond. Based on conservative estimates and assuming taxable value remains steady, payment of the 2023 bond would fit within the existing rate or possibly be even lower. This is possible because the District would structure future bond payments to layer with existing bond payments in a way that keeps the total amount of taxes assessed per year within the current tax rate.

Property taxes are calculated by multiplying the tax rate by the property value. While some taxpayers may experience increases in taxes paid for the school district bond debt, this would be the result of increased property values and not due to a higher tax rate.

By approving this bond, taxpayers would be taking on additional debt, which will require a longer period of time to pay. In other words, without the issuance of this new debt, taxes would be lowered in upcoming years. If this debt is issued according to the plan, the overall tax burden on district taxpayers should remain approximately the same as now going forward.

The District has a reputation for paying off its debt early through refinancing opportunities. The District also has a strong reputation for meeting project timelines and staying within budget. More information about this can be found in the Bond Accountability section.