Our District

Families

Departments

Please Note: The Gilboa-Conesville Central School Tax Collection period has ended. Taxes may be paid at the County Treasurer's Office for which your property is located through November 30, 2023. All school taxes remaining unpaid on December 1, 2023, will be relevied on the 2023 Town and County Taxes.

SCHOOL TAX INFORMATION

School tax bills are mailed out in late August. Taxpayers should anticipate their tax bills to be delivered by mail on September 1, 2023.

2023/2024 School tax information for district properties will be available on September 1, 2023. You may visit https://www.infotaxonline.com/FindProperty.aspx?113.

Payments made will appear as paid after the tax collection period has ended.

2023/2024 Tax Collection Period

School property tax bills are due by September 30, 2023. All taxes paid or postmarked after September 30th shall bear an interest charge of two percent (2%) until October 31, 2023. No tax payments will be accepted or processed by the school tax collector postmarked after October 31, 2023. All taxes remaining unpaid after October 31, 2023, shall be returned to the appropriate County Treasurer for further collection.

Payments can be made by mailing exact payment due to the tax collector.

Please make checks payable to:

Mandy VanValkenburgh

Tax Collector

132 Wyckoff Road

Gilboa, NY 12076

(607)588-7541

Please do not mail cash.

In addition, tax collection will be at the school Monday-Friday from 8 a.m.-4 p.m.

Payments in cash or check will be accepted on-site. Change will not be provided.

****This year, we have introduced online payments for tax bills. If you would like to pay online, you may visit infotaxonline.com. Please note: A 2.65% service fee will be included on all credit card payments. Gilboa-Conesville Central School District will only receive the principal amount owed on the Tax bill. Service fees are imposed by the vendor (Municipal) and are remitted directly to them. The fees do not increase the district’s tax revenue.

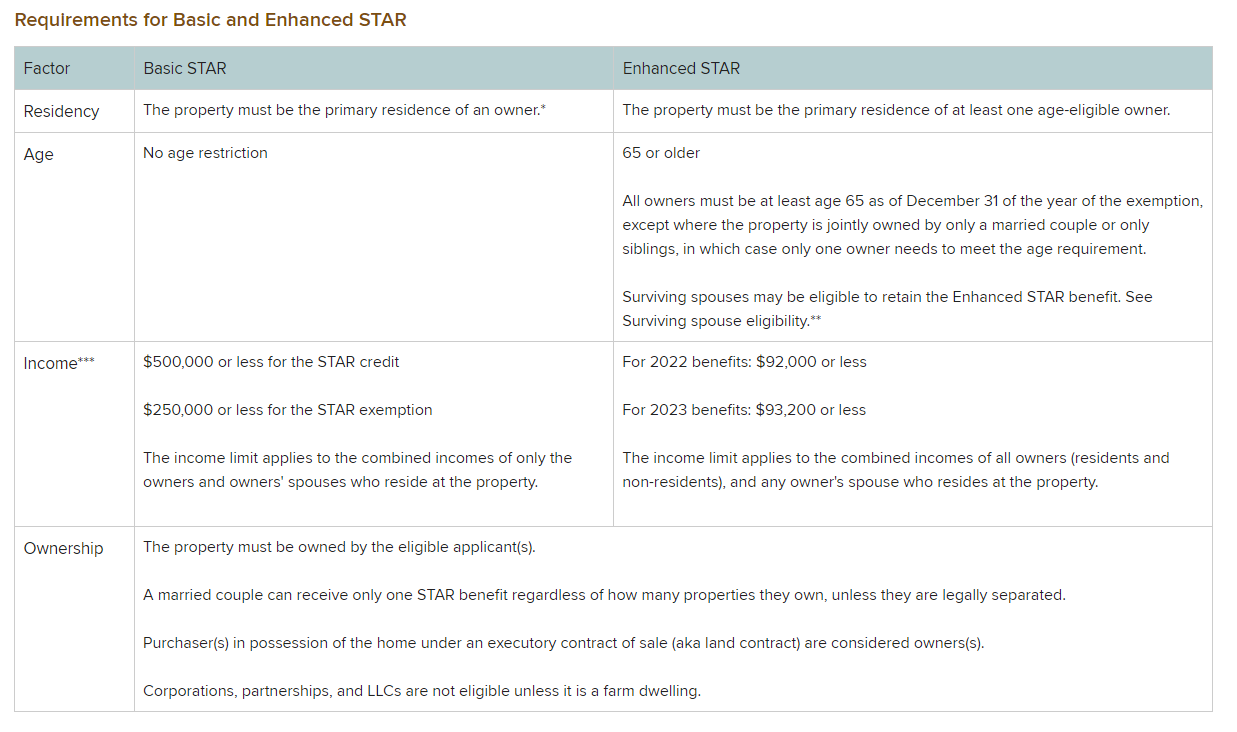

STAR (SCHOOL TAX RELIEF) EXEMPTION/CREDIT

Municipality | Enhanced exemption | Basic exemption | Date certified |

Town of Blenheim | $53,180 | $21,300 | 04/07/2022 |

Town of Broome | $74,900 | $30,000 | 04/07/2022 |

Town of Conesville | $74,900 | $30,000 | 04/07/2022 |

Town of Fulton | $44,190 | $17,700 | 04/07/2022 |

Town of Gilboa | $1,720 | $690 | 7/5/2022 |

Town of Roxbury | $67,410 | $27,000 | 4/7/2022 |

Town of Ashland | $50,930 | $20,400 | 4/7/2022 |

Town of Lexington | $72,090 | $28,880 | 4/7/2022 |

Town of Prattsville | $71,900 | $28,800 | 4/7/2022 |

For more information about the STAR program, click below on the following links:

Learn more about the STAR program

If you have any other questions about assessed values or exemptions, contact your assessor below using the appropriate County webpage:

Delaware County –

Roxbury: http://roxburyny.com/departments/assessors-office/

Schoharie County -

Broome: https://www4.schohariecounty-ny.gov/government/town-of-broome/assessors/

Blenheim: https://www4.schohariecounty-ny.gov/government/town-of-blenheim/blenheim-town-assessor/#top

Conesville: https://www4.schohariecounty-ny.gov/government/town-of-conesville/conesville-town-assessors/#top

Gilboa: https://www4.schohariecounty-ny.gov/government/town-of-gilboa/assessors/

Fulton: https://www4.schohariecounty-ny.gov/government/town-of-fulton/fulton-town-assessors/#top

Greene County -

Ashland: https://www.ashlandny.com/government

Lexington: https://www.lexingtonny.com/assessor

Prattsville: https://www.townofprattsville.com/departments

County Information – Real Property Tax Services:

Delaware County (607) 832-5130

Greene County (518) 719-3527

Schoharie County (518) 295-8386